5.2 Price-Level Changes

Learning Objectives

- Define inflation and deflation, explain how their rates are determined, and articulate why price-level changes matter.

- Explain what a price index is and outline the general steps in computing a price index.

- Describe and compare different price indexes.

- Explain how to convert nominal values to real values and explain why it is useful to make this calculation.

Concern about changes in the price level has always dominated economic discussion. With inflation in Canada generally averaging only between 1% and 3% each year since 1996, it may seem surprising how much attention the behaviour of the price level still commands. Yet inflation was a concern in 2004 when there was fear that the rising price of oil could trigger higher prices in other areas. Just the year before, when inflation fell below 2%, there was talk about the risk of deflation. That did not happen; prices continued rising. Inflation rose substantially in the first half of 2008, renewing fears about subsequent further increases. 2010 brought on renewed concern of possible deflation. Just what are inflation and deflation? How are they measured? And most important, why do we care? These are some of the questions we will explore in this section.

Inflation is an increase in the average level of prices, and deflation is a decrease in the average level of prices. In an economy experiencing inflation, most prices are likely to be rising, whereas in an economy experiencing deflation, most prices are likely to be falling.

There are two key points in these definitions:

- Inflation and deflation refer to changes in the average level of prices, not to changes in particular prices. An increase in medical costs is not inflation. A decrease in gasoline prices is not deflation. Inflation means the average level of prices is rising, and deflation means the average level of prices is falling.

- Inflation and deflation refer to rising prices and falling prices, respectively; therefore, they do not have anything to do with the level of prices at any one time. “High” prices do not imply the presence of inflation, nor do “low” prices imply deflation. Inflation means a positive rate of change in average prices, and deflation means a negative rate of change in average prices.

Why Do We Care?

What difference does it make if the average level of prices changes? First, consider the impact of inflation.

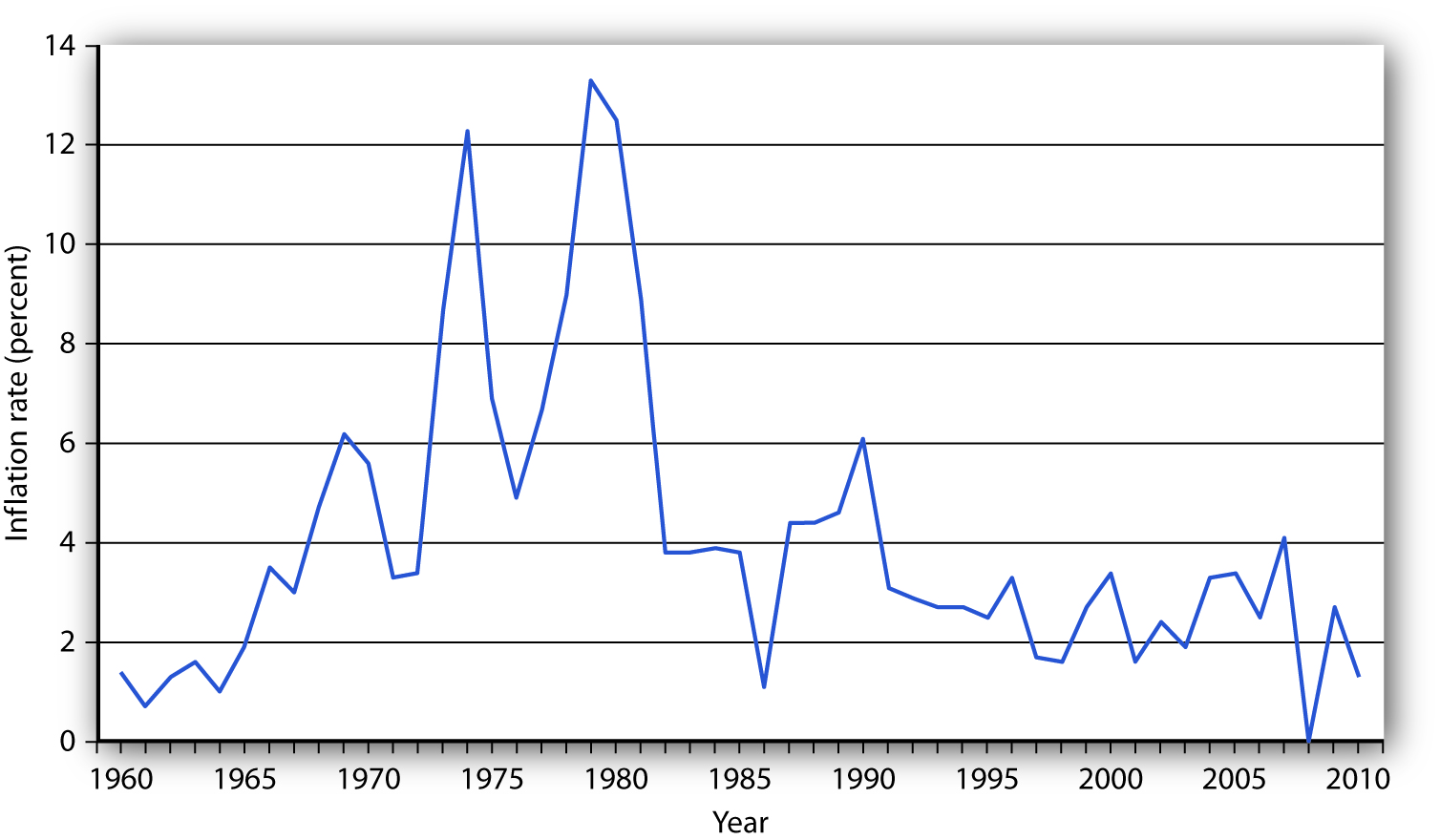

Inflation is measured as the annual rate of increase in the average level of prices. Figure 5.6 “Inflation, 1960–2010” shows how volatile inflation has been in the United States over the past four decades. In the 1960s the inflation rate rose, and it became dramatically worse in the 1970s. The inflation rate plunged in the 1980s and continued to ease downward in the 1990s. It remained low in the early 2000s and began to accelerate in 2007 and has remained low since.

Figure 5.6 Inflation, 1960–2010

The U.S. inflation rate, measured as the annual rate of change in the average level of prices paid by consumers, varied considerably over the 1960–2010 period.

Source: Bureau of Labor Statistics, All Urban Consumers CPI-U, 1982–84 = 100, Dec.–Dec. inflation rate. Data for 2010 is through October. and https://takloo.wordpress.com/2010/07/20/canadas-historical-inflation-rate-1916-to-2010/

Here is a look at inflation in Canada from 1960 through 2018:

Historical Inflation Rates in Canada

Whether one regards inflation as a “good” thing or a “bad” thing depends very much on one’s economic situation. If you are a borrower, unexpected inflation is a good thing—it reduces the value of money that you must repay. If you are a lender, it is a bad thing because it reduces the value of future payments you will receive. Whatever any particular person’s situation may be, inflation always produces the following effects on the economy: it reduces the value of money and it reduces the value of future monetary obligations. It can also create uncertainty about the future.

Suppose that you have just found a $10 bill you stashed away in 1990. Prices have increased by about 50% since then; your money will buy less than what it would have purchased when you put it away. Your money has thus lost value.

Money loses value when its purchasing power falls. Since inflation is a rise in the level of prices, the amount of goods and services a given amount of money can buy falls with inflation.

Just as inflation reduces the value of money, it reduces the value of future claims on money. Suppose you have borrowed $100 from a friend and have agreed to pay it back in one year. During the year, however, prices double. That means that when you pay the money back, it will buy only half as much as it could have bought when you borrowed it. That is good for you but tough on the person who lent you the money. Of course, if you and your friend had anticipated such rapid inflation, you might have agreed to pay back a larger sum to adjust for it. When people anticipate inflation, they can adjust for its consequences in determining future obligations. But unanticipated inflation helps borrowers and hurts lenders.

Inflation’s impact on future claims can be particularly hard on people who must live on a fixed income, that is, on an income that is predetermined through some contractual arrangement and does not change with economic conditions. An annuity, for example, typically provides a fixed stream of money payments. Retirement pensions sometimes generate fixed income. Inflation erodes the value of such payments.

Given the danger posed by inflation for people on fixed incomes, many retirement plans provide for indexed payments. An indexed payment is one whose dollar amount changes with the rate of change in the price level. If a payment changes at the same rate as the rate of change in the price level, the purchasing power of the payment remains constant. Social Security payments, for example, are indexed to maintain their purchasing power.

Because inflation reduces the purchasing power of money, the threat of future inflation can make people reluctant to lend for long periods. From a lender’s point of view, the danger of a long-term commitment of funds is that future inflation will wipe out the value of the amount that will eventually be paid back. Lenders are reluctant to make such commitments.

Uncertainty can be particularly pronounced in countries where extremely high inflation is a threat. Hyperinflation is generally defined as an inflation rate in excess of 200% per year. Inflation of that magnitude erodes the value of money very quickly. Hyperinflations occurred in Germany in the 1920s and in Yugoslavia in the early 1990s. There are stories about how people in Germany during the hyperinflation brought wheelbarrows full of money to stores to pay for ordinary items. In Yugoslavia in 1993 there was a report of a shop owner barring the entrance to his store with a mop while he changed his prices.

The inflation rate rose to an astronomical rate in 2008 in Zimbabwe. As the government printed more money and put it in circulation, prices rose. When inflation began to accelerate, the government found it “necessary” to print more and more money, causing prices to rise very fast. The inflation rate in Zimbabwe reached an astonishing 11.2 million percent in July of 2008, according to Zimbabwe’s Central Statistics Office. A loaf of bread cost 200,000 Zimbabwe dollars in February 2008. That same loaf cost 1.6 trillion Zimbabwe dollars by August (CNN, 2008).

Do the problems associated with inflation imply that deflation would be a good thing? The answer is simple: no. Like inflation, deflation changes the value of money and the value of future obligations. It also creates uncertainty about the future.

If there is deflation, the real value of a given amount of money rises. In other words, if there had been deflation since 2000, a $10 bill you had stashed away in 2000 would buy more goods and services today. That sounds good, but should you buy $10 worth of goods and services now when you would be able to buy even more for your $10 in the future if the deflation continues? When Japan experienced deflation in the late 1990s and early 2000s, Japanese consumers seemed to be doing just that—waiting to see if prices would fall further. They were spending less per person and, as we will see throughout our study of macroeconomics, less consumption often meant less output, fewer jobs, and the prospect of a recurring recessions.

And, if you had to use the $10 to pay back a debt you owed, the purchasing power of your money would be higher than when you borrowed the money. The lender would feel good about being able to buy more with the $10 than you were able to, but you would feel like you had gotten a raw deal.

Unanticipated deflation hurts borrowers and helps lenders. If the parties anticipate the deflation, a loan agreement can be written to reflect expected changes in the price level.

The threat of deflation can make people reluctant to borrow for long periods. Borrowers become reluctant to enter into long-term contracts because they fear that deflation will raise the value of the money they must pay back in the future. In such an environment, firms may be reluctant to borrow to build new factories, for example. This is because they fear that the prices at which they can sell their output will drop, making it difficult for them to repay their loans.

Deflation was common in the United States in the latter third of the 19th century. In the 20th century, there was a period of deflation after World War I and again during the Great Depression in the 1930s.

Price Indexes

How do we actually measure inflation and deflation (that is, changes in the price level)? Price-level change is measured as the percentage rate of change in the level of prices. But how do we find a price level?

Economists measure the price level with a price index. A price index is a number whose movement reflects movement in the average level of prices. If a price index rises 10%, it means the average level of prices has risen 10%.

There are four steps one must take in computing a price index:

- Select the kinds and quantities of goods and services to be included in the index. A list of these goods and services, and the quantities of each, is the “market basket” for the index.

- Determine what it would cost to buy the goods and services in the market basket in some period that is the base period for the index. A base period is a time period against which costs of the market basket in other periods will be compared in computing a price index. Most often, the base period for an index is a single year. If, for example, a price index had a base period of 1990, costs of the basket in other periods would be compared to the cost of the basket in 1990. We will encounter one index, however, whose base period stretches over three years.

- Compute the cost of the market basket in the current period.

- Compute the price index. It equals the current cost divided by the base-period cost of the market basket.

Equation 20.1

[latex]Price index = current cost of basket/base-period cost of basket[/latex]

(While published price indexes are typically reported with this number multiplied by 100, our work with indexes will be simplified by omitting this step.)

Suppose that we want to compute a price index for movie fans, and a survey of movie watchers tells us that a typical fan rents 4 movies on DVD and sees 3 movies in theaters each month. At the theater, this viewer consumes a medium-sized soft drink and a medium-sized box of popcorn. Our market basket thus might include 4 DVD rentals, 3 movie admissions, 3 medium soft drinks, and 3 medium servings of popcorn.

Our next step in computing the movie price index is to determine the cost of the market basket. Suppose we surveyed movie theaters and DVD-rental stores in 2007 to determine the average prices of these items, finding the values given in Table 5.1 “Pricing a Market Basket”. At those prices, the total monthly cost of our movie market basket in 2007 was $48. Now suppose that in 2008 the prices of movie admissions and DVD rentals rise, soft-drink prices at movies fall, and popcorn prices remain unchanged. The combined effect of these changes pushes the 2008 cost of the basket to $50.88.

Table 5.1 Pricing a Market Basket

| Item | Quantity in Basket | 2007 Price | Cost in 2007 Basket | 2008 Price | Cost in 2008 Basket |

|---|---|---|---|---|---|

| DVD rental | 4 | $2.25 | $9.00 | $2.97 | $11.88 |

| Movie admission | 3 | 7.75 | 23.25 | 8.00 | 24.00 |

| Popcorn | 3 | 2.25 | 6.75 | 2.25 | 6.75 |

| Soft drink | 3 | 3.00 | 9.00 | 2.75 | 8.25 |

| Total cost of basket | 2007 |

$48.00 | 2008 |

$50.88 |

To compute a price index, we need to define a market basket and determine its price. The table gives the composition of the movie market basket and prices for 2007 and 2008. The cost of the entire basket rises from $48 in 2007 to $50.88 in 2008.

Using the data in Table 5.1 “Pricing a Market Basket”, we could compute price indexes for each year. Recall that a price index is the ratio of the current cost of the basket to the base-period cost. We can select any year we wish as the base year; take 2007. The 2008 movie price index (MPI) is thus

[latex]MPI_{2008} = \$ 50.88/ \$ 48 = 1.06[/latex]

The value of any price index in the base period is always 1. In the case of our movie price index, the 2007 index would be the current (2007) cost of the basket, $48, divided by the base-period cost, which is the same thing: $48/$48 = 1.

The Consumer Price Index (CPI)

One widely used price index in Canada is the consumer price index (CPI), a price index whose movement reflects changes in the prices of goods and services typically purchased by consumers. When the media report the U.S. inflation rate, the number cited is usually a rate computed using the CPI. The CPI is also used to determine whether people’s incomes are keeping up with the costs of the things they buy. The CPI is often used to measure changes in the cost of living, though as we shall see, there are problems in using it for this purpose.

The market basket for the CPI contains thousands of goods and services. The composition of the basket is determined by Statistics Canada. Surveyors tally the prices of the goods and services in the basket each month in cities all over Canada to determine the current cost of the basket. The major categories of items in the CPI are food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services.

The current cost of the basket of consumer goods and services is then compared to the base-period cost of that same basket. The base year is currently 2002, and the basket for that year is given the value of 100. In 2012 the CPI averaged 121.7, which means that what you could buy for $100 in 2002 cost $121.70 in 2012. Each month’s CPI thus reflects the ratio of the current cost of the basket divided by its base-period cost.

Equation 5.2

[latex]CPI = current\ cost\ of\ basket/1982-1984\ cost\ of\ basket[/latex]

Like many other price indexes, the CPI is computed with a fixed market basket. The composition of the basket generally remains unchanged from one period to the next. Because buying patterns change, however, the basket is revised accordingly.

Computing the Rate of Inflation or Deflation

The rate of inflation or deflation is the percentage rate of change in a price index between two periods. Given price-index values for two periods, we can calculate the rate of inflation or deflation as the change in the index divided by the initial value of the index, stated as a percentage:

Equation 5.4

[latex]Rate\ of\ inflation\ or\ deflation = percentage\ change\ in\ index/initial\ value\ of\ index[/latex]

To calculate inflation in movie prices over the 2007–2008 period, for example, we could apply Equation 5.4 to the price indexes we computed for those two years as follows:

[latex]Movie\ inflation\ rate\ in\ 2008 = (1.06-1.00)/1.00 = -.06 = 6%[/latex]

The CPI is often used for calculating price-level change for the economy. For example, the rate of inflation in 2007 can be computed from the December 2006 price level (2.016) and the December 2007 level (2.073):

[latex]Inflation\ rate = (2.073-2.016)/2.016 = 0.028 = 2.8%[/latex]

Price indexes are useful. They allow us to see how the general level of prices has changed. They allow us to estimate the rate of change in prices, which we report as the rate of inflation or deflation. And they give us a tool for converting nominal values to real values so we can make better comparisons of economic performance across time.

Key Takeaways

- Inflation is an increase in the average level of prices, and deflation is a decrease in the average level of prices. The rate of inflation or deflation is the percentage rate of change in a price index.

- The consumer price index (CPI) is the most widely used price index in Canada.

- Nominal values can be converted to real values by dividing by a price index.

- Inflation and deflation affect the real value of money, of future obligations measured in money, and of fixed incomes. Unanticipated inflation and deflation create uncertainty about the future.

Case in Point: Take Me Out to the Ball Game …

Keith Allison – Boston Red Sox Celebrating a Win – CC BY-SA 2.0.

The cost of a trip to the old ball game jumped 7.9% in 2008, according to Team Marketing Report, a Chicago-based newsletter. The report bases its estimate on its fan price index, whose market basket includes two adult average-priced tickets, two child average-priced tickets, two small draft beers, four small soft drinks, four regular-sized hot dogs, parking for one car, two game programs, and two least expensive, adult-sized adjustable baseball caps. The average price of the market basket was $191.92 in 2008.

Team Marketing compiles the cost of the basket for each of major league baseball’s 30 teams. According to this compilation, the Boston Red Sox was the most expensive team to watch in 2008; the Tampa Bay Rays was the cheapest. The Rays made it to the World Series in 2008; the Red Sox did not. By that measure, the Rays were something of a bargain. The table shows the cost of the fan price index market basket for 2008.

| Team | Basket Cost | Team | Basket Cost |

|---|---|---|---|

| Boston Red Sox | $320.71 | San Francisco Giants | $183.74 |

| New York Yankees | $275.10 | Cincinnati Reds | $167.14 |

| Chicago Cubs | $251.96 | Minnesota Twins | $165.71 |

| New York Mets | $251.19 | Baltimore Orioles | $165.40 |

| Toronto Blue Jays | $230.46 | Florida Marlins | $164.26 |

| Los Angeles Dodgers | $229.14 | AZ Diamondbacks | $162.84 |

| St. Louis Cardinals | $217.28 | Colorado Rockies | $160.00 |

| Houston Astros | $215.45 | Atlanta Braves | $157.15 |

| Chicago White Sox | $214.51 | Kansas City Royals | $151.16 |

| Oakland Athletics | $206.80 | Texas Rangers | $148.04 |

| San Diego Padres | $201.72 | Pittsburgh Pirates | $146.32 |

| Philadelphia Phillies | $199.56 | Milwaukee Brewers | $141.52 |

| Washington Nationals | $195.50 | Los Angeles Angels | $140.42 |

| Cleveland Indians | $192.38 | Tampa Bay Rays | $136.31 |

| Seattle Mariners | $191.16 | MLB Average | $191.92 |

| Detroit Tigers | $190.13 |

Sources: Team Marketing Report, TMR’s Fan Cost Index Major League Baseball 2008 at http://www.teammarketing.com and personal interview.

References

Cage, R., John Greenlees, and Patrick Jackman, “Introducing the Chained Consumer Price Index” (paper, Seventh Meeting of the International Working Group on Price Indices, Paris, France, May 2003), available at http://stats.bls.gov/cpi/superlink.htm.

CNN, “Zimbabwe Inflation Hits 11,200,000%,” CNN.com, August 19, 2008.